Get the free hawaii tax form g 49 fillable

Show details

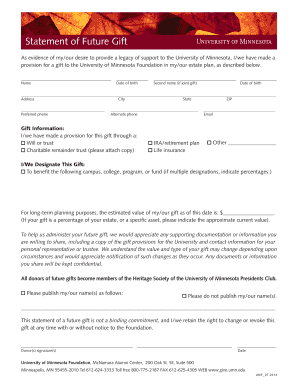

FORM G-49 (Rev. 2008) WEB STATE OF HAWAII -- DEPARTMENT OF TAXATION DO NOT WRITE IN THIS AREA GENERAL EXCISE/USE ANNUAL RETURN & RECONCILIATION 16 GCI081 Fill in this oval ONLY if this is an AMENDED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your hawaii tax form g form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hawaii tax form g form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hawaii tax form g 49 fillable online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit state tax form g 49. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

How to fill out hawaii tax form g

How to fill out Hawaii tax form G:

01

Gather all necessary documentation and information, such as your personal identification details, income statements, and deductions.

02

Carefully read the instructions for Hawaii tax form G to understand the specific requirements and sections you need to complete.

03

Enter your personal information, including your name, address, and Social Security number, in the relevant fields.

04

Provide details about your income, such as wages, dividends, rental income, or self-employment earnings, in the designated sections of the form.

05

Calculate and report your deductions, including expenses related to healthcare, education, mortgage interest, or charitable contributions, as applicable.

06

Carefully review your form for accuracy and completeness to avoid any errors or omissions.

07

Sign and date the form before submitting it to the appropriate tax authority, either electronically or by mail.

Who needs Hawaii tax form G:

01

Individuals who have earned income from Hawaii sources during the tax year may need to file Hawaii tax form G.

02

Residents of Hawaii who have received income from sources outside of the state may also need to complete this form.

03

Non-residents of Hawaii who have earned income within the state are required to file Hawaii tax form G to report and pay taxes on that income.

04

Individuals who are eligible for any tax credits or deductions specific to Hawaii may need to fill out this form to claim those benefits.

Fill how to file g 49 online : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is hawaii tax form g?

Hawaii Tax Form G is used by individuals who are residents of Hawaii and who are not required to file a federal income tax return, but have gross income from Hawaii sources and need to report and pay their state taxes. It is also used by nonresidents who have income from Hawaii sources and need to file a state tax return. Form G is a simplified version of Hawaii Tax Form N-11 and is used for reporting income, deductions, and tax liability.

Who is required to file hawaii tax form g?

Hawaii Tax Form G is required to be filed by taxpayers who have received income from sources outside of Hawaii that is subject to taxation in Hawaii. This includes individuals, partnerships, estates and trusts, and corporations.

How to fill out hawaii tax form g?

To fill out the Hawaii Tax Form G, also known as the Nonresident and Part-Year Resident Schedule, you will need to follow these steps:

1. Gather necessary information: Obtain your federal tax return and gather all relevant documents, including your W-2 forms, 1099-MISC forms, and any other income statements.

2. Determine your residency status: Determine if you are a part-year resident or a nonresident for tax purposes. A part-year resident is someone who lived in Hawaii for only part of the year, while a nonresident is someone who didn't live in Hawaii at all during the tax year.

3. Income calculation: Determine your total income during the year and multiply it by the appropriate percentage based on your residency status. For example, if you were a part-year resident, you would calculate the percentage of income earned while you were residing in Hawaii.

4. Complete the form: Fill out the Hawaii Tax Form G by providing your personal information, including your name, Social Security Number (SSN), and address. Indicate your residency status by checking the appropriate box.

5. Report income: Report your income in the corresponding sections of the form, including wages, salaries, tips, and other compensation in Part II. If you have any other income, such as self-employment income or rental income, report it in the applicable sections.

6. Deductions and adjustments: Deduct any eligible adjustments to income in Part III of the form. These may include student loan interest, tuition and fees deduction, self-employed health insurance deduction, etc.

7. Compute your Hawaii tax liability: Use the tax tables provided in the instructions for Form G to determine your Hawaii tax liability based on your taxable income.

8. Complete the form: Fill out the remaining sections of the form, including the signature and date at the bottom. Attach the completed form to your Hawaii individual income tax return.

9. File your tax return: Mail your completed Form G, along with other required forms, to the Hawaii Department of Taxation. The mailing address can be found on the form instructions or on the department's website.

Note: It's important to review the specific instructions provided with the Hawaii Tax Form G and consult with a tax professional if you have any uncertainties or complex tax situations.

What is the purpose of hawaii tax form g?

Hawaii Tax Form G is used by businesses and organizations operating in the state of Hawaii to report and remit General Excise and Use Taxes. General Excise Tax (GET) is a tax on the gross income generated from business activities, while Use Tax is applied to goods and services purchased outside the state but used within Hawaii. Form G is used to calculate the amount of tax owed and report it to the Hawaii Department of Taxation.

What information must be reported on hawaii tax form g?

Tax Form G in Hawaii is used to report gain or loss from the disposition of real property located in Hawaii by non-residents. The following information must be reported on Hawaii Tax Form G:

1. Personal information: This includes your name, Social Security Number or Individual Taxpayer Identification Number, and contact information.

2. Property information: You must provide details about the property being sold, including its address, purchase date, and sale date.

3. Sale proceeds: Report the total amount received from the sale of the property.

4. Adjustments: Any allowable deductions or adjustments related to the sale should be reported here. This may include costs such as real estate commissions, legal fees, or other selling expenses.

5. Basis and depreciation: If you previously claimed depreciation on the property, you should report the adjusted basis after depreciation.

6. Calculation of gain or loss: Subtract your adjusted basis from the sale proceeds to calculate the gain or loss from the sale.

7. Non-resident withholding: If the buyer is required to withhold any amount for non-resident withholding tax, you should report the withheld amount.

8. Computation of tax: Report any tax credits or other applicable deductions to determine the final tax liability.

9. Signature: Sign and date the form to certify that the information provided is true and accurate.

It is important to note that this information is a general summary, and individuals should refer to the specific instructions and guidelines provided by the Hawaii Department of Taxation when completing Tax Form G.

What is the penalty for the late filing of hawaii tax form g?

The penalty for late filing of Hawaii Tax Form G (General Excise/Use Tax Return) is 5% of the tax due for each month the return is late, up to a maximum penalty of 25%. There is also an additional 2% penalty per month for failure to pay the tax due.

Where do I find hawaii tax form g 49 fillable?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific state tax form g 49 and other forms. Find the template you need and change it using powerful tools.

How do I execute g 49 tax form online?

pdfFiller makes it easy to finish and sign hawaii g49 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out hawaii g 49 on an Android device?

Complete g49 hawaii tax form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your hawaii tax form g online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

G 49 Tax Form is not the form you're looking for?Search for another form here.

Keywords relevant to hawaii g 49 instructions form

Related to g49

If you believe that this page should be taken down, please follow our DMCA take down process

here

.